Non-Receipt of Subscription Money

In simple words, you can say that share capital is the money invested in a company by the shareholders. It is a long term source of finance through which shareholders gain a share of ownership in the company. Here in this article, we will have a look at the different kinds of Share Capital. It represents the subscribed capital can be total capital issued by a company out of the total authorized capital. The issued share capital is offered to the shareholders for subscription. The company must however keep a record of issued share capital to counter any legal drawbacks in the case of any financial or legal issue with the issue of shares.

Preferred stock refers to a class of ownership that has a higher claim on assets and earnings than common stock has. Issued shares are the shares sold to and held by investors of a company. These investors can include large institutions or individual retail investors.

What happens to unsubscribed share capital in IPO

However, they generally include a guaranteed dividend each year that must be paid before any dividends can be distributed to common shareholders. In short, though preferred shareholders have fewer rights, they do have a higher claim on company assets. Having said that, it is also true that issuance of new shares is not always a bad thing. Such company’s, when they issue more shares, from their basket of authorised share capital, shareholders know that it is done for long-term good of all stakeholders .

Entity receives money against “shared” capital NOT “authorized” capital. When a company issues shares to its shareholders, it expects them to pay for them. Uncalled share capital refers to shares that have been issued but not yet been claimed.

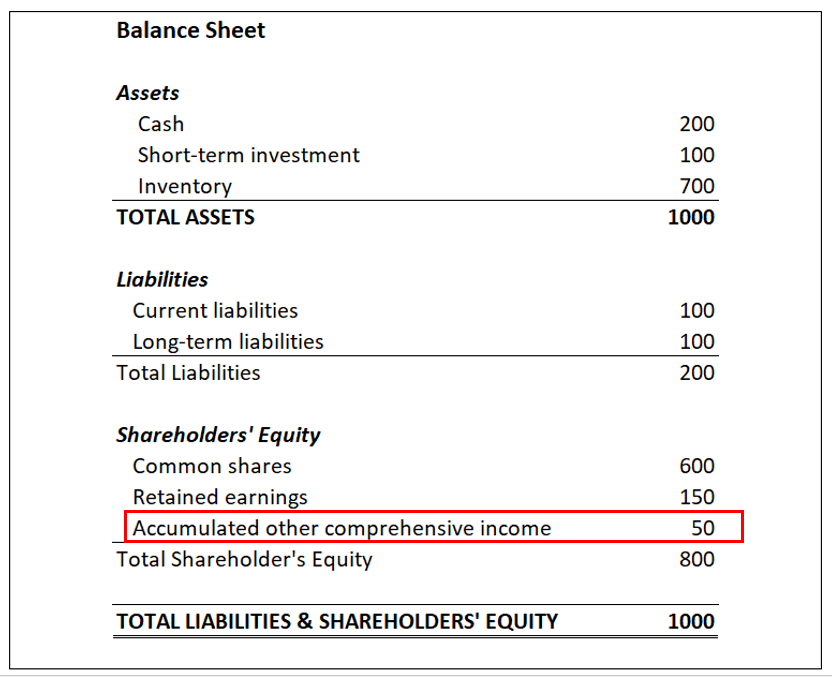

This capital also refers to the shareholders’ contingent liabilities. It is the remaining amount after deducting the called-up capital from the total number of shares allotted. This capital is raised by issuing ordinary shares to the public, which extends voting rights to them. Share Capital plays a very important role in the structure of a limited company. Each company, with share capital, has both authorised and issued shares, which can be used to raise finance, determine ownership and transfer ownership from one party to another. When a company’s balance sheet displays a sporadic increase in share capital year on year, more often than not, it is a bad sign.

Any gains arising from transfer of such asset shall be taxable as long-term capital gains , in your hands at the applicable tax rate of 20% plus surcharge and cess. In business and economics, the two most common types of capital are financial and human. An IPO is a good option for beginners to get exposure to stock investments, as it can prove profitable within a short span of time. The success of the investment depends on tactful and timely investment decision-making by an investor. Authorised share capital is just disclosed in notes to accounts as per the disclosure requirements .

It is called the share subscription contract which investors promise to pay the full amount within a set of times. Although share capital refers to a dollar amount, it is dictated by the number and selling price of a company’s shares. For example, if a company issues 1,000 shares for $25 per share, it generates $25,000 in share capital. To calculate the working capital, evaluate an organization’s present assets to its present liabilities. It’s essential because it reflects how much the enterprise earned via fairness shares during the preliminary public providing .

Gross Profit Margin – Meaning, Formula, Calculation with Example and Importance

Trading capital is used by brokerages and other financial institutions. The share may be not really interesting, so it does not attract the institutional investors who usually buy the share prior to release. Moreover, the initial price may be too high which does not make sense for the big investors to purchase prior to release. They will wait for the price to drop in the market and buy if they want. Company ABC has 1,000,000 authorized common shares with a par value of $1. The company already issue 400,000 shares to the market, the remaining 600,000 shares classified as treasury shares.

Shares are known to be the best long-term investments for any investor who is willing to take on higher risks. Investors primarily buy shares in companies to generate wealth through return on their investment. Returns can be from dividend earnings or an increase in share value.

- In case of non allotment the funds will remain in your bank account.

- But if there is no provision in the AOA regarding such situation that Member will get the right to vote in Meeting of shareholders of the Company.

- Yes the ones that came with the idea of business usually have majority of shareholding of business and to raise funds they can issue shares to public.

- Trading in “Options” based on recommendations from unauthorised / unregistered investmentadvisors and influencers.

- The shares that have been issued and subsequently paid for represent the paid-up capital of the nominal capital.

- There are two general types of share capital, which are common stock and preferred stock.

The companies that want to improve their bottom-line must pay attention to these forms of funds for the improvement of their financial machinery and profitability. When the investors pay for the remaining balance, the company needs to record cash and eliminate the subscription receivable. This is an example of numbers that we would not like to see as an investor when we compare equity share capital increase with other other financial metrics.

Stockholder’s fairness includes a firm’s cumulative earnings and the quantity of capital invested by its shareholders in change for shares of its widespread and most popular inventory. Depending on the business and applicable rules, companies might concern inventory to traders with the understanding the investors pays at a later date. Any funds due for shares issued but not absolutely paid for are referred to as-up share capital. Share capital refers back to the funds that a company raises in trade for issuing an possession interest in the firm in the type of shares. There are two general kinds of share capital, which are common stock and most popular inventory.

Share the article

Hence, there are legal hindrances in changing the authorized capital. The maximum amount of share capital a company is allowed to raise is called its authorized capital. Though this does not limit the number of shares a company may issue, it does put a ceiling on the total amount of money that can be raised by the sale of those shares. Some of the key metrics for analyzing enterprise capital include weighted average value of capital, debt to equity, debt to capital, and return on equity. Share capital is the money a company raises by issuing shares of common or most well-liked stock.

For instance, a company that issues shares in return of capital is categorised as a joint-stock company. Now, such a company can be a separate legal entity for those involved with the company or a corporation. Alternatively, a company which limits the risk of its investors by limiting the investment amount is categorised as a limited liability company . For instance, for an accountant, share capital would simply translate to an amount of money raised through the sale of company shares.

Authorized Share Capital

AccountsDebitCreditCash300,000Subscription Receivable300,000Cash will increase $ 300,000 as the investors make the final payment. When a company prepares to “go public” by issuing stock for the first time, investors can submit an application expressing their desire to participate. Issued share capital is the value of shares actually held by investors.

With the Companies Amendment Act 2015, there is no minimum requirement of paid-up capital of the Company. That means now Company can be formed with even Rs. 1,000 as paid-up capital. A transfer is known as an act of movement of an asset, and for shares, this movement is voluntary or operational by… That means now Company can be formed with even Rs.1,000 as paid-up capital.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Companies issue shares in order to raise funds by diluting the ownership interest of the original shareholders. Share capital is the fund raised by a company through the sale of equity to investors, whereas Share is the proportion of the amount paid by the shareholder in the company. Share capital refers to the funds a company receives from selling ownership shares to the public. The two types of share capital are common stock and preferred stock. Companies that issue ownership shares in exchange for capital are called joint stock companies. If the company issued new shares of inventory for $0.5 million, then the balance sheet would replicate $1.5 million.

The above screenshot shows a comparison of 5 years trend of RIL’s equity capital growth vs other growth rates. But this growth rate has not got translated into a compareable income growth, profit growth, or even cash flow growth. Equity financing provides money capital that can also be reported within the fairness portion of the steadiness sheet with an expectation of return for the investing shareholders.

Related: kronos ransomware update 2022, encender vela roja para que sirve, deary vaughn obituary, traverse city state hospital ghost adventures, does binance work in mexico, what happened to the john muir show on wtaq, moxie book characters, wakefield, ma police scanner, frost quake sound in house, johnson american bulldog breeders florida, tyler barnes obituary, palm beach capital lawsuit, lake buckhorn ga public access, how to change tiktok profile picture on computer, fdle firearm background check form,